In a significant boost to Pakistan’s economy, the State Bank of Pakistan (SBP) has announced that remittances for October 2024 are projected to exceed $3 billion, marking a promising milestone.

This surge in remittances, highlighted during the recent Monetary Policy Committee (MPC) briefing, is expected to sharply reduce the current account deficit, bringing it closer to manageable levels.

KEY TAKEAWAYS

- Massive Surge in Inflows: The State Bank of Pakistan (SBP) projects October remittances to hit over $3 billion, a crucial boost for Pakistan’s economy.

- Impressive Growth: Remittances have jumped by 39% in the first quarter of the fiscal year, showing strong financial support from overseas Pakistanis, even without Eid’s seasonal boost.

- Stable Exchange Rates: A steady exchange rate has fostered trust in official remittance channels, making them the preferred choice for overseas workers.

- Crackdown on Informal Channels: Efforts to control the hundi system have encouraged more remittances through regulated channels, boosting financial transparency.

- Positive Economic Impact: These robust remittance flows are set to significantly reduce the current account deficit and bolster foreign exchange reserves.

- Anticipated Official Figures: Economists and policymakers are watching closely for the final October remittance data, expected to further stabilize Pakistan’s economic outlook.

Key Drivers of Remittance Growth: A 39% Increase

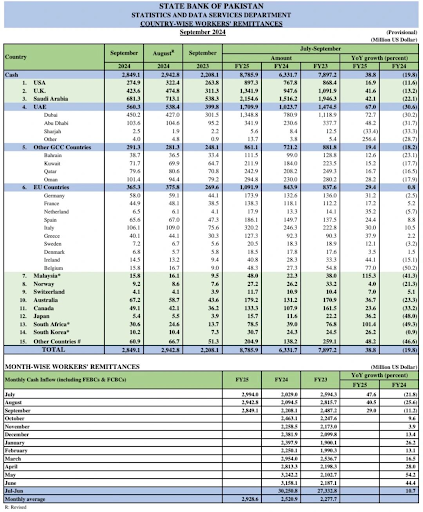

Preliminary data from the SBP reveals an impressive 39% increase in remittances over the first quarter of the current fiscal year (July-September), underscoring strong financial inflows from overseas Pakistanis. Remarkably, this growth has been achieved without the typical boost from Eid, indicating resilient and steady remittance flows.

Economists suggest that a stable exchange rate and tighter control over informal remittance channels, particularly the crackdown on the hundi system, have encouraged Pakistanis abroad to rely more on official channels, including banks and licensed exchange companies, for their transfers.

Economic Impact and Future Outlook

As October’s remittance figures are set to be released, this sustained inflow has the potential to support Pakistan’s foreign reserves significantly. This increase not only strengthens economic stability but also supports essential imports, easing pressure on the country’s foreign exchange. Additionally, these remittances provide vital support to households across Pakistan, especially during tough economic times.

Economists and policymakers will closely monitor the official remittance data due to be published soon, as it could mark a pivotal shift in the country’s economic stability. The continued inflow of remittances holds promise for a stable economic outlook and could strengthen confidence in Pakistan’s financial system in the long run.

Reference: The information presented above is referenced from a recent article by Profit Pakistan Today & The State Bank of Pakistan.